Summary

Australia has experienced three decades of almost uninterrupted economic growth. These times are now under serious threat. We pose the question of how ready are our business leaders in plotting the course and steering us through stormy seas when most of their lived experience has been in a growth economy?

We have spoken to our network of business leaders, many of whom have experience in leading and thriving through prior recessions or downturns such as ‘the recession we had to have’, the ‘tech wreck’ and the GFC. These leaders agree that proactivity and decisiveness are the two major attributes that helped them steer their businesses through challenging macro-economic times, which often saw them emerge stronger against competition in their given market.

Whilst ideally, leaders have experienced all such economic situations, this is never the case, and so the ability of a leader to apply lessons of the past to their current situation and evolve solutions and initiatives, will be the secret to success in these times.

A key aspect to this is the regular and systematic evaluation of execution versus plan at all levels of the business, from Boards to Executives and Middle management, to ensure external factors are not adversely impacting delivery. When problems occur, they must be dealt with quickly before they escalate into organisational damage at a faster rate than usual, due to the prevailing recessionary environment.

Some of the key messages from the business leaders to whom we spoke are:

“the best way to prepare for a downturn is a balanced approach to cost savings and increased productivity which focuses on ‘no regrets’ improvements”

“use capital wisely”

“it is important to define and implement ‘clear decision rights’"

“protect your most important assets; of course, this includes your best people”

“be well-positioned to take advantage of the downturns that lie ahead”

“with preparedness, business leaders can pivot swiftly"

“do not cut costs indiscriminately; base decisions on the potential value gained/lost”

Introduction

As we face these uncertain times, we realise that there is little experience in our management teams in Australia today of managing, surviving and even thriving in downturns in our economy. In fact, by 2017, Australia experienced the longest period of uninterrupted Gross Domestic Product (GDP) growth in the developed world, which ultimately lasted nearly 30 years before the brief COVID recession in 2020.

So, we decided to speak with senior executives and board members of organisations who successfully navigated through the early 90’s recession, the tech crash of the late 90’s and early 2000s, and the Global Financial Crisis (GFC), in 2008/9. Although we have seen considerable change over the past 30 years, particularly technologically, there is much to learn from those who have experienced these matters firsthand and handled them successfully. The fundamentals of business remain, fundamentals.

Although, in Australia, we avoided a ‘technical recession’ for thirty years, many segments of the economy experienced major downturns and recession-like conditions. The overall economy has been propped up by what we dig and what we grow. So, we have not had the advantages of the major restructures which have occurred in other economies. Further, our population growth via relatively high immigration masks productivity gains. From 1991 to 2017, Australia experienced only three, non-consecutive quarters of negative growth and over the same period had the fifth highest immigration level in the OECD. When considering GDP per capita, there were many of negative growth but only two periods of back-to-back negative quarters per capita. Therefore, Australia’s GDP growth is not as positive as the media headlines.

The COVID pandemic triggered lockdowns from early 2020, and much of the advice to leap forward post-COVID lockdowns will apply to post-recession. Most commentary has had a global focus, where the GFC was the reference point. For example, McKinsey’s series on Resilents highlights the top-quartile outperformance on Total Shareholder Return (TSR) from companies that were better prepared.

Australia differed again, remaining in lockdowns much longer than other OECD countries, and our government support for industries also differed. Whilst debt never substitutes for lost revenue, many Australian companies were forced to increase debt to ‘survive’ sustained trading restrictions. Debt costs are only increasing for the foreseeable future.

We discuss the perspectives of our interviewees across our network:

Summary view for the next few years

Overall messages for the year ahead

A synthesis of increased opportunity during lower growth periods:

Growth

Operational Savings

Financial Discipline and Project Portfolio Optimisation

Digitisation and Technology

We frame preparatory steps to take advantage

Summary view for the next few years

In our discussions, we received varying views on what lies ahead economically. The following encapsulates these and our views.

A former major bank CEO said “the reality is that the world is awash with debt, there is widespread stagnation with high inflation and low growth prospects. The purchasing power of currencies will cause a crisis of confidence in many economies.”

The changed economic conditions make this decade different and provide the motivation, need and opportunity to review and renew strategies.

There is general agreement that a recession is likely in some economies but at least a downturn in most. When coupled with increased geopolitical instability, global supply chains will continue to come under pressure.

The guidance from our discussions, is that in Australia, it is prudent to review and adjust key strategy and performance settings to help prepare for an uncertain future. If conducted appropriately, regardless of the economic scenario, this will create value for the organisation.

Overall messages for the year ahead

It is likely that a downturn will lead to the identification of excess organisational capacity. Getting the balance right between cost savings and diverting capacity into productivity improvement will be key. This is compounded by the difficulties already experienced in the pandemic.

Leverage the opportunity or never waste a good crisis

A recession (or major downturn) is a catalyst to review and improve your organisation. Multiple leaders reflected on the gift of an external catalyst. The catalyst provides a mandate to make, or bring forward, changes that they would like to make in good times. Bad times focus the team and can diffuse organisational politics.

Do what you should always do

From experience, the best way to prepare for a downturn is a balanced approach which focuses on “no regrets” improvements to both efficiency and effectiveness. This greatly increases the odds of a company effectively enduring the downturn and flourishing when it comes to an end. Instead of focusing primarily on reducing costs while trying to avoid impacting revenue, a balanced approach requires an understanding and trade-off between revenue opportunity and cost reduction. Always remaining relentless with focus on activities that deliver to your organisation’s purpose.

Momentum

When looking at an impending downturn as a potential opportunity, rather than solely as an ordeal to be endured, change momentum can bring forward desired outcomes. These often have strategic longer-term benefits such as increased market share, structurally improving revenue generation effectiveness, and ultimately emerging from the recession in a stronger competitive position, i.e. operating at full capacity while competitors are still ramping up.

As one Logistics Executive stated, companies that look at their businesses from the outside in (i.e., talk to their customers!) and monitor their competitors, always do better than companies that do the reverse, particularly in challenging times.

Money is no longer free

A leading board member and past senior executive, in technology, banking and real estate advised us to: “use capital wisely”. This board member has watched several companies in Australia which have been actively preparing for a downturn for some years and using their experience of the GFC as a guide.

Clear Strategy and Clear Decision Rights

Revised strategies should be communicated throughout the organisation and understood at all levels, with every investment/capital raising tested against the revised strategy. This can foster belief and ‘excitement’ that the organisation is well-positioned to take advantage of the downturns that lie ahead.

As advised by a former chairman of a global manufacturing company and ex-senior marketing executive, it is important to define and implement “clear decision rights” throughout the organisation in an orderly fashion, particularly in the context of any revised approach for recession preparedness. Some contemporary management approaches promote decisions at the lowest practical level (e.g., product management). It is therefore critical that the contribution to organisation strategy remains clear for all products and projects through change.

Protect your best customers

Retain your most important and most profitable customers. Understanding and agreeing on who they are and who they could be moving forward, is essential for this process. For example, what is the right course of action if there are significant volume declines with larger customers?

Global supply chain and talent shortage challenges require difficult decisions to provide scarce products to these most important customers and how to support secondary customers by saying no, not yet or lead to alternatives.

Protect your best people and attract your competitors’ best

Last but obviously not least, we must not lose our best people.

When facing the prospect of a severe downturn, an organisation must protect its most important assets. Of course, this includes its best people. Engage with them and reward them, particularly as the economy improves. This is particularly important, with Australia having come through COVID lockdowns, staff are already feeling 'fragile'. Add to this the potential personal impact of interest rates, cost of living, and nervousness about how their business will survive a recession.

The COVID lockdowns did create, or at least normalise, more flexible ways of working that can help reduce costs whilst avoiding full redundancies. Part-time or job-based roles, and of course, reduced accommodation costs, all should be factored into the future operating model.

Strong organisations use recessionary times to recruit talent actively. This is a threat to organisations struggling to survive. The founder of a successful technology company said they “hired aggressively during the GFC”.

Actively communicate the recession preparedness approach and ensure that it is understood at all levels of the organisation and that decisions made are in the context of the organisation’s value-based revised strategy.

A leading board member and past senior executive in technology and banking advised: “foster belief and ‘excitement’ throughout the organisation that it is well-positioned to take advantage of the downturns that lie ahead”.

Encourage people to embrace the change that the organisation is going through and the benefits that it will bring. We argue that people can only embrace change if they understand it, which requires clarity not just on a utopic Vision or North Star, but also on the main stages to get there.

Classic areas with new opportunity

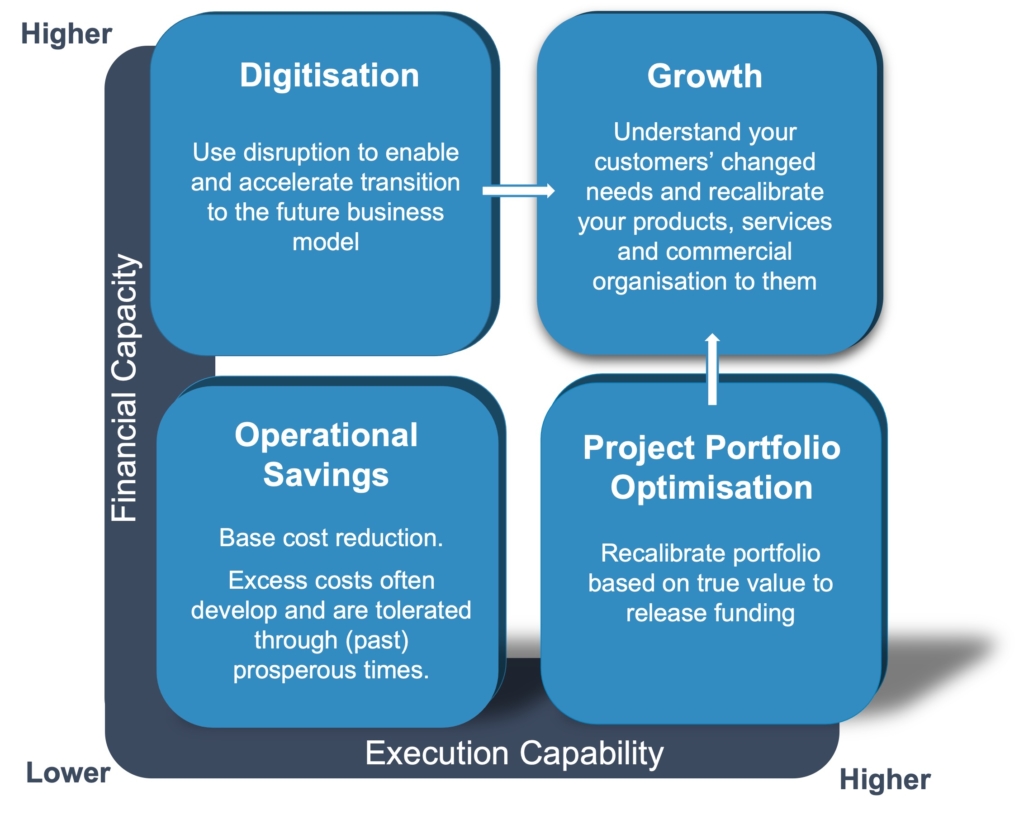

Each opportunity area below is sensible in any economic situation. Leverage the current uncertainty as a catalyst for change, whilst being mindful of your financial capacity and execution capability relative to your main competitors:

Each opportunity area is summarised below.

Growth

Growth is obviously the most appealing opportunity since it is the greatest contributor to value creation and motivates teams to adopt an offensive mindset when others play defence. Yet, it requires the execution capability and adequate financial capacity (reprioritised from elsewhere) to do well.

Effective leaders continually look ahead to seek the first signs of market changes that will impact customer behaviour and revenue performance. Recent quarters provide signals that the short-term future will be challenging. How do you best prepare if the downturn turns out to be not as severe as predicted? How do you know that you are doing better than competitors and how do you quickly calibrate your approach?

With preparedness, business leaders can pivot swiftly, with purpose and confidence. To execute a balanced approach and prepare a company to successfully navigate a potential recession, there are five areas on which leaders could focus:

1.Assess changing buyer values. Speak directly with current customers, prospects, and others in the marketplace to understand how buyer values are likely to change in the event of a recession and to understand changing competitor positioning better.

2. Sharpen focus on sales execution. When confronted with a downturn, the most important objective in most industries is to take care of existing customers. Where possible, increase support for channel partners, key salespeople and mechanisms.

3. Rebalance the coverage model. Take a fresh look at how to deploy your sales resources and configure channels to align with a new set of buyer values.

4. Tighten sales management discipline. As with the coverage model, sales management discipline tends to weaken during strong markets when teams are meeting targets. Invigorate sales management discipline when preparing for a recession.

5. Resync the product portfolio with buyer values. As buyer values change in a downturn or recession, it is essential to tune the portfolio of products so that the organisation sells what customers want to buy.

Inflation is currently a global challenge; a perfect catalyst (and need) to review pricing. Everyone expects everyone to pass on input costs, but this is too simple. Instead, substantial pricing shifts can be leveraged to introduce more profitable models and lock in structural gains.

Operational Savings

The advice from an ex-Chairman of a manufacturing company and former senior marketing executive was “do not cut costs indiscriminately”. Base decisions on the potential value gained/lost for the organisation and where you want to be, as growth in the economy recovers.

Leaders typically start with across-the-board budget cuts, asking their teams to “do more with less” while hoping revenue does not suffer too much. The usual recipe for recession survival, includes actions such as freezing headcount, reducing expenses (e.g., travel, conferences), postponing training and deferring systems enhancements, and protecting ‘cash cows’ while lengthening new product development cycles. While prudent cost management is certainly healthy, these typical broad-brush actions can disrupt revenue generation just when needed most, making the recovery slower than it would be otherwise. Several people paraphrased the point to cut the fat, not the muscle.

Downturns tend to trigger M&A activity. ‘Bargains’ appear in the market. The decision to acquire should be based on the value potentially gained from the ‘combined’ organisation. This includes the level of integration and the initiatives to achieve this. Integration projects can be expensive and often do not deliver the required outcomes. This is often a project failure or possibly due to inadequate due diligence. Also, it may be important to consider the option to ‘demerge’ in the future. Organisations may use M&A as a defensive measure to avoid predators.

Financial Discipline and Project Portfolio Optimisation

Much has been said by commentators about financial management in contractionary cycles; and the need to (re)focus on balance sheet strength. They justifiably argue that winners in past cycles managed the balance sheet as strategically as they did the P&L.

A recession is typically associated with lower sales and therefore lower cash to fund operations, let alone investments or projects. An instinctive reaction is to divest non-core assets whereas, as expressed by the CFO of a logistics company, divesting low value projects is quicker and offers sustained savings and benefits. The CFO challenged each product manager to “show me the money”. Further, the COO of the same organisation was wary to “avoid the blunt instrument of cost cutting without also reviewing functions and activities” as those costs are likely to creep back in, or customer experience and employee effectiveness will suffer.

A project in this article represents any form or scale of initiative, particularly wary of operationalisation of project spend through Agile related ways-of-working that have become popular since the last economic contraction. Cash is cash. The evolution of funding models to smaller, more frequent capital or operational allocations shouldn’t disguise the opportunity to prune. All interviewees argued that a hard and true assessment of each product’s or project’s financial and non-financial value would likely identify financial capacity to reinvest through the downward cycle.

It is clear is that individual product or project owners can’t or won’t rationalise themselves – they have an inherently myopic perspective based on narrow data. Only a portfolio perspective can inform a strategic response to change in a recessionary period.

Clarity on the real financial gains can help identify which projects are “self-funding”, or how existing projects can self-fund earlier. These are often not transformative (i.e. substantial customer or business change) and can be low-tech or no-tech.

Several concerns were raised about interest rate movement, the risk of credit rating decline, and likely higher taxation following a period of excessive government borrowing and aggressive monetary policy. All unprecedented for current today’s management teams.

Digitisation and Technology

All of our interviewees referenced the impact of technology, and the digitalisation of processes and the digitisation of products, over the past decade and clearly the past three decades. Customer behaviour has been irreversibly altered, and the momentum of change will only continue to accelerate. However, technology has always been, is, and will be, an enabler. Software is simply an automated process. Leveraging the crisis to get the process right will inform where to cut technology and digital expenditure, and where to double-down on it.

In good times, organisations can make decisions (often indiscriminately) on ‘advancing’ their technology capability. Here focus may be on having the best system, for example, not always clearly producing the best outcomes for the organisation and its customers. Reflecting on our last recessionary period, two of Australia’s major banks had significant technology investments leading up to the early 90’s recession. These large projects were a drain on cost and resources and diversions from core business. Both banks struggled to survive the recession. Their executives and some board members didn’t!

Since then, there has been many technology investments, in many sectors, that have fallen short of expectations and/or were substantially late and over budget. Whilst fiscally constrained periods will (re)shine the light on any fiscal waste, a key strategic implication of slowing down digital-enabled transformation is likely a weakened competitive position.

Overall, recessionary times provide an opportunity for organisations to re-assess the spending on technology and the returns from this investment. One CIO argued that organisations should invest more in recessionary times since the opportunity cost is lower. The CEO needs to be comfortable that the direction still aligns with a potential pivot in strategy? It is essential to review the investment portfolio in the context of the economic situation and evolving competitive landscape and prioritise according to projected value delivered and risk appetite. Can we develop and innovate better than our competitors? This can lead to increased focus on core business and improved business outcomes, customer service and shareholder value. Thus, creating more certain progress for increasingly uncertain times.

Preparatory steps

The interviewee insights above require a structured approach to leverage since the challenges are diverse and the opportunities are many. You can’t do them all; or at least, do them all better than your competitors.

Prioritisation is key, and prioritisation justifies (re)value assessment and comparison across all projects. Recession preparedness (increases) the need to neutralise any valuation differences that have organically developed in projects or parts of your business over time. A convenient and attractive characteristic of a recession or contraction is that the data is external (i.e. government or industry analysis); thus providing a catalyst for review. Any internal analysis should pay particular attention to what each product or service does for the competitive position within the context of changing economic and market drivers.

The only assured way to waste this crisis is not make material change in some or all of the opportunity areas above.

Interviewees framed the dual challenge as:

- Ensuring each initiative is optimally scoped, sequenced, and resourced; whilst

- Pursuing new projects at a time when we are expected to reduce expenditure.

Ultimately, you may just “tighten a few loose nuts” or alternatively implement a wholesale change of strategy, operating model, and project portfolio.

We frame the preparatory steps as:

Executive led preparation to improve investment in growth

Responsible Executives to lead validation (and subsequent optimisation) of their project’s value proposition.

- This will equip them to compare different projects (i.e. under each of the four broad categories above) in a fair, fact-based manner.

- The organisation is then presented with informed choice.

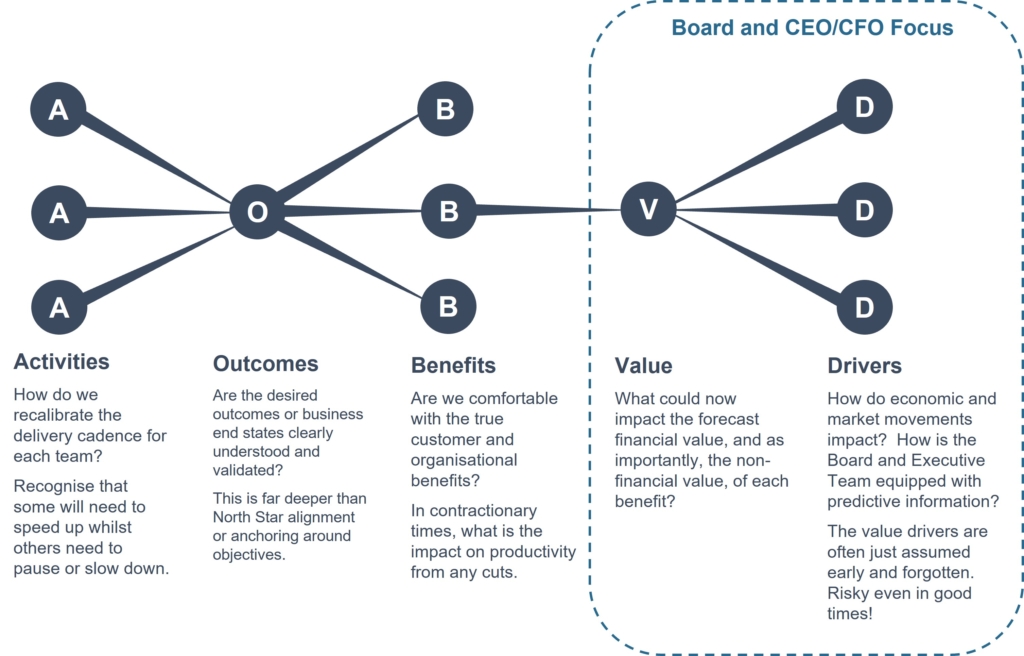

Every aspect of delivery can be measured, but it’s not always easy (or popular) to do so. Over time, myopic or local perspectives can develop resulting in expensive inertia. Further, team-level assumptions manifest in passionate defence of products or projects. To form a common basis for all, we find it productive to break down the proposition into its pure elements as represented by the value equation below:

There is more insight in the relationship between each element, and each team, than the actual assessment of any element.

The challenge is not whether a product enables, or a project creates ‘value’ but is it creating sufficient value, in adequate time, against other choices. This will lead to consideration of enterprise-level drivers and any risks that may reduce customer or stakeholder value. Risk assessments look at opportunities as well as risks, and the 'outside in' lens is also applied.

Overall, how do we execute practically and ruthlessly. With tightening and validation, are the dependencies clear across our ecosystem of partners and suppliers? How do we avoid over investing in any product or service?

CEO led preparation to increase financial capacity and execution capability

To do more with less is a perpetual objective; and as raised through this paper, today’s environment presents an opportunity we haven’t seen in Australia for a very long time.

The matrix above illustrates how lower-maturity activities (i.e. cost cutting) and enabling activities (i.e. digitisation and real portfolio valuation) can fuel organic growth.

Execution Capability

This is best understood, and subsequently improved, by assessing and equipping the Board (and sub-committees) and Executive Team with richer information. Easily and often said, it is easier to break valuation back down to basics and recompile to cut through shifting organisational structures. Many reports seek to simplify but ultimately become simplistic.

Most argue, and we agree, this is best equipped and facilitated through a genuinely strategic function. However, we disagree that this should be a seconded consulting team but rather Executive level members who mature capability with haste.

This may disband existing operationally focussed meetings to ensure the Executive spend adequate time on strategic, holistic matters and analysis. Such analysis can only be performed at enterprise level to reinvent many enterprise-level offices2 that are typically still administrative; effectively just rolling-up data. The former Chair of a global manufacturing company said now, more than ever, there “needs to be clear decision rights”.

Financial Capacity

A purposeful review of the portfolio, and timely and perhaps seemingly ruthless decisions to reprioritise, will help the whole become greater than the sum of parts. Financial capacity can be created – it needs to be created - either to increase reserves for tumultuous times or invest in growth.

Distinct from prior recessions, recent trends in enterprise funding models that create higher cadence and greater team autonomy, often lose strategic traction or progress under the belief the future is too dynamic to predict. In most Australian markets, this is a very risky belief to hold. Further, there is an opportunity to challenge generous infrastructure or asset expenditure. All projects deemed enabling growth or cost reduction should ensure the linkages remain measurable and attributable.

The bottom line is arguably best helped by a focus on improving the top-line. Insights from Blue Ridge Partners at Driving Revenue Growth in a Downturn or specifically pricing which can flow directly through to results at Pricing In Turbulent Times.

We believe a focus on growth – particularly in a contractionary economic period - will pull through financial capacity from other expenditure areas. Prudent cost cutting is likely overdue, digitisation will have a clear(er) purpose, and the project and product portfolio optimised.

Recent years have provided two once-in-a-generation catalysts – pandemic related lockdowns and economic contraction. If no changes are made, at least you know. If changes are made, your financial strength is better for it.

About Capability Network

Capability is a leader in optimising the execution of strategy through our team and network of proven professional and specialist partners.

We complement our client’s leadership team to equip and assist the delivery of their most important operational, digital and growth initiatives. We have supported many Australian corporates and numerous strategic roles for Government.

For more information visit www.capability.com.au

About Blue Ridge Partners

Blue Ridge Partners is recognised as the most experienced, impactful and respected firm that is exclusively focused on helping companies accelerate profitable revenue growth. We have worked with hundreds of companies on commercial model transitions, where we are known for rolling up our sleeves, being focused and pragmatic in our analyses and delivering tangible results. In our work with over 700 clients worldwide, we have amassed extensive knowledge of the issues that affect revenue performance.

For more information visit www.blueridgepartners.com